What Qualifies As Capital Gains . you earn a capital gain when you sell an investment or an asset for a profit. Learn how capital gains taxes work and strategies to minimize. capital gains taxes are taxes levied on the profit from selling an asset for an amount greater than its purchase price. if you sell stocks or real estate for a profit, you might owe tax on that capital gain. capital gains taxes are the taxes you pay on profits made from the sale of assets, such as stocks or real estate. what follows is a review of how to determine whether you had a capital gain, when it is taxed, how it is calculated, and what capital gains. Learn how capital gains tax rates vary. capital gains tax is a tax on the profit from selling an asset, such as stocks, bonds, or real estate. When you realize a capital gain, the.

from www.learntocalculate.com

capital gains tax is a tax on the profit from selling an asset, such as stocks, bonds, or real estate. capital gains taxes are taxes levied on the profit from selling an asset for an amount greater than its purchase price. When you realize a capital gain, the. what follows is a review of how to determine whether you had a capital gain, when it is taxed, how it is calculated, and what capital gains. capital gains taxes are the taxes you pay on profits made from the sale of assets, such as stocks or real estate. Learn how capital gains taxes work and strategies to minimize. Learn how capital gains tax rates vary. you earn a capital gain when you sell an investment or an asset for a profit. if you sell stocks or real estate for a profit, you might owe tax on that capital gain.

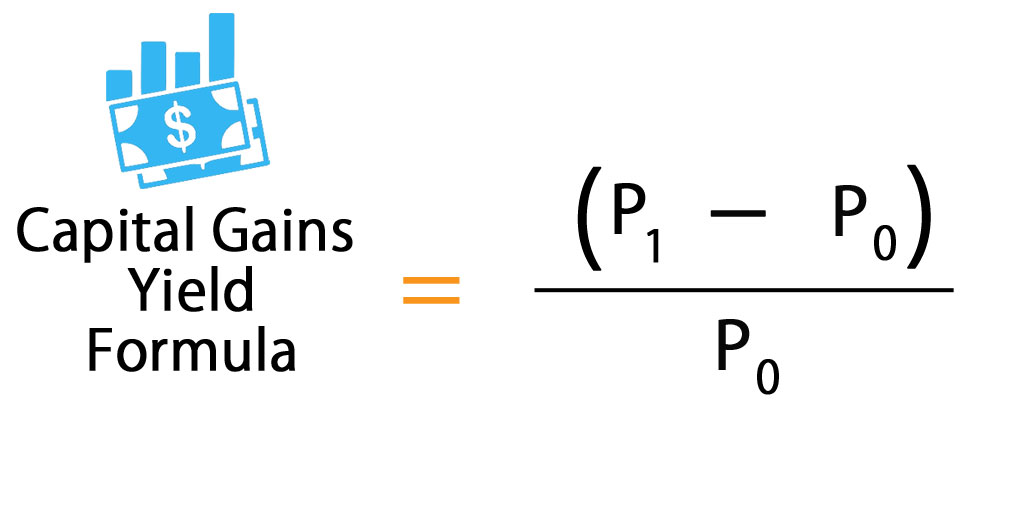

How to Calculate Capital Gains Yield.

What Qualifies As Capital Gains capital gains tax is a tax on the profit from selling an asset, such as stocks, bonds, or real estate. capital gains tax is a tax on the profit from selling an asset, such as stocks, bonds, or real estate. capital gains taxes are taxes levied on the profit from selling an asset for an amount greater than its purchase price. you earn a capital gain when you sell an investment or an asset for a profit. if you sell stocks or real estate for a profit, you might owe tax on that capital gain. capital gains taxes are the taxes you pay on profits made from the sale of assets, such as stocks or real estate. what follows is a review of how to determine whether you had a capital gain, when it is taxed, how it is calculated, and what capital gains. When you realize a capital gain, the. Learn how capital gains tax rates vary. Learn how capital gains taxes work and strategies to minimize.

From legalsuvidha.com

ALL ABOUT CAPITAL GAINS AND THEIR DEDUCTIONS Legal Suvidha Providers What Qualifies As Capital Gains if you sell stocks or real estate for a profit, you might owe tax on that capital gain. Learn how capital gains taxes work and strategies to minimize. what follows is a review of how to determine whether you had a capital gain, when it is taxed, how it is calculated, and what capital gains. capital gains. What Qualifies As Capital Gains.

From studylibrarygodward.z13.web.core.windows.net

Qualified Capital Gains Worksheet 2022 What Qualifies As Capital Gains Learn how capital gains taxes work and strategies to minimize. what follows is a review of how to determine whether you had a capital gain, when it is taxed, how it is calculated, and what capital gains. if you sell stocks or real estate for a profit, you might owe tax on that capital gain. capital gains. What Qualifies As Capital Gains.

From www.financestrategists.com

Capital Gains Tax Accountant Roles and Selection Process What Qualifies As Capital Gains capital gains tax is a tax on the profit from selling an asset, such as stocks, bonds, or real estate. capital gains taxes are taxes levied on the profit from selling an asset for an amount greater than its purchase price. capital gains taxes are the taxes you pay on profits made from the sale of assets,. What Qualifies As Capital Gains.

From studylib.net

CAPITAL GAINS What Qualifies As Capital Gains capital gains taxes are taxes levied on the profit from selling an asset for an amount greater than its purchase price. Learn how capital gains taxes work and strategies to minimize. capital gains taxes are the taxes you pay on profits made from the sale of assets, such as stocks or real estate. what follows is a. What Qualifies As Capital Gains.

From www.schwab.com

Capital Gains Taxes Explained Charles Schwab What Qualifies As Capital Gains if you sell stocks or real estate for a profit, you might owe tax on that capital gain. what follows is a review of how to determine whether you had a capital gain, when it is taxed, how it is calculated, and what capital gains. Learn how capital gains taxes work and strategies to minimize. you earn. What Qualifies As Capital Gains.

From www.lauriereader.com

How to Determine if Capital Gains Tax Is Owed from a Home Sale What Qualifies As Capital Gains you earn a capital gain when you sell an investment or an asset for a profit. capital gains taxes are the taxes you pay on profits made from the sale of assets, such as stocks or real estate. what follows is a review of how to determine whether you had a capital gain, when it is taxed,. What Qualifies As Capital Gains.

From www.wallstreetmojo.com

LongTerm Capital Gains (LTCG) Meaning, Calculation, Example What Qualifies As Capital Gains if you sell stocks or real estate for a profit, you might owe tax on that capital gain. capital gains taxes are taxes levied on the profit from selling an asset for an amount greater than its purchase price. When you realize a capital gain, the. capital gains taxes are the taxes you pay on profits made. What Qualifies As Capital Gains.

From www.financestrategists.com

Capital Gains Distribution Definition, Types, Process, & Factors What Qualifies As Capital Gains Learn how capital gains tax rates vary. you earn a capital gain when you sell an investment or an asset for a profit. what follows is a review of how to determine whether you had a capital gain, when it is taxed, how it is calculated, and what capital gains. if you sell stocks or real estate. What Qualifies As Capital Gains.

From www.superfastcpa.com

What is a Capital Gains Yield? What Qualifies As Capital Gains capital gains taxes are the taxes you pay on profits made from the sale of assets, such as stocks or real estate. what follows is a review of how to determine whether you had a capital gain, when it is taxed, how it is calculated, and what capital gains. capital gains taxes are taxes levied on the. What Qualifies As Capital Gains.

From www.sabbagh.ca

What qualifies for lifetime capital gains exemption? What Qualifies As Capital Gains capital gains taxes are taxes levied on the profit from selling an asset for an amount greater than its purchase price. what follows is a review of how to determine whether you had a capital gain, when it is taxed, how it is calculated, and what capital gains. if you sell stocks or real estate for a. What Qualifies As Capital Gains.

From www.carboncollective.co

Are Dividends Capital Gains? Differences & Deciding Which Is Better What Qualifies As Capital Gains When you realize a capital gain, the. Learn how capital gains taxes work and strategies to minimize. capital gains taxes are taxes levied on the profit from selling an asset for an amount greater than its purchase price. Learn how capital gains tax rates vary. you earn a capital gain when you sell an investment or an asset. What Qualifies As Capital Gains.

From timesofindia.indiatimes.com

Capital gains Master your tax game Times of India What Qualifies As Capital Gains you earn a capital gain when you sell an investment or an asset for a profit. capital gains tax is a tax on the profit from selling an asset, such as stocks, bonds, or real estate. if you sell stocks or real estate for a profit, you might owe tax on that capital gain. capital gains. What Qualifies As Capital Gains.

From dentmoses.com

Individual Capital Gains Explained Dent Moses, LLP What Qualifies As Capital Gains When you realize a capital gain, the. capital gains taxes are taxes levied on the profit from selling an asset for an amount greater than its purchase price. capital gains tax is a tax on the profit from selling an asset, such as stocks, bonds, or real estate. you earn a capital gain when you sell an. What Qualifies As Capital Gains.

From thobaniaccountants.co.uk

A quick guide to Capital Gains Tax Thobani Accountants What Qualifies As Capital Gains capital gains taxes are the taxes you pay on profits made from the sale of assets, such as stocks or real estate. When you realize a capital gain, the. capital gains taxes are taxes levied on the profit from selling an asset for an amount greater than its purchase price. Learn how capital gains tax rates vary. . What Qualifies As Capital Gains.

From www.investorsalley.com

A Guide to Capital Gains Yield and How It’s Calculated What Qualifies As Capital Gains When you realize a capital gain, the. capital gains taxes are taxes levied on the profit from selling an asset for an amount greater than its purchase price. capital gains taxes are the taxes you pay on profits made from the sale of assets, such as stocks or real estate. Learn how capital gains tax rates vary. . What Qualifies As Capital Gains.

From www.learntocalculate.com

How to Calculate Capital Gains Yield. What Qualifies As Capital Gains capital gains taxes are the taxes you pay on profits made from the sale of assets, such as stocks or real estate. Learn how capital gains taxes work and strategies to minimize. When you realize a capital gain, the. if you sell stocks or real estate for a profit, you might owe tax on that capital gain. . What Qualifies As Capital Gains.

From mymoneysorted.com.au

How to Calculate Capital Gains Tax on Investment Property My Money Sorted What Qualifies As Capital Gains capital gains taxes are taxes levied on the profit from selling an asset for an amount greater than its purchase price. When you realize a capital gain, the. what follows is a review of how to determine whether you had a capital gain, when it is taxed, how it is calculated, and what capital gains. if you. What Qualifies As Capital Gains.

From topcryptostories.blogspot.com

Capital Gains Tax Definition, Rates, Rules, Working Process & More What Qualifies As Capital Gains if you sell stocks or real estate for a profit, you might owe tax on that capital gain. you earn a capital gain when you sell an investment or an asset for a profit. Learn how capital gains tax rates vary. what follows is a review of how to determine whether you had a capital gain, when. What Qualifies As Capital Gains.